October 2024 brought stability to the European automobile market, recording 1,040,390 new car registrations a marginal 0.1% decrease from the same month in 2023.

Despite this steadiness, it was evident that the industry lacked the dynamism to break free from its lingering stagnation.

Notably, compared to September 2024, the market saw a drop of nearly 79,000 registrations, highlighting the challenges facing automakers in sustaining consistent growth.

From January to October 2024, cumulative sales have shown a modest increase of 1.1%, with 10.79 million cars sold across Europe.

Electrification continued to shine, with battery electric vehicles (BEVs) witnessing a 6.7% growth from the previous year.

In stark contrast, diesel cars faced an 8.1% decline, further solidifying the market’s pivot toward greener technologies.

Plug-in hybrids (PHEVs) also saw a decrease of 7.2%, whereas traditional petrol vehicles experienced a slight 0.7% growth. This shift is significant, reflecting the growing consumer preference for fully electric models over transitional alternatives.

Dacia Sandero Leads

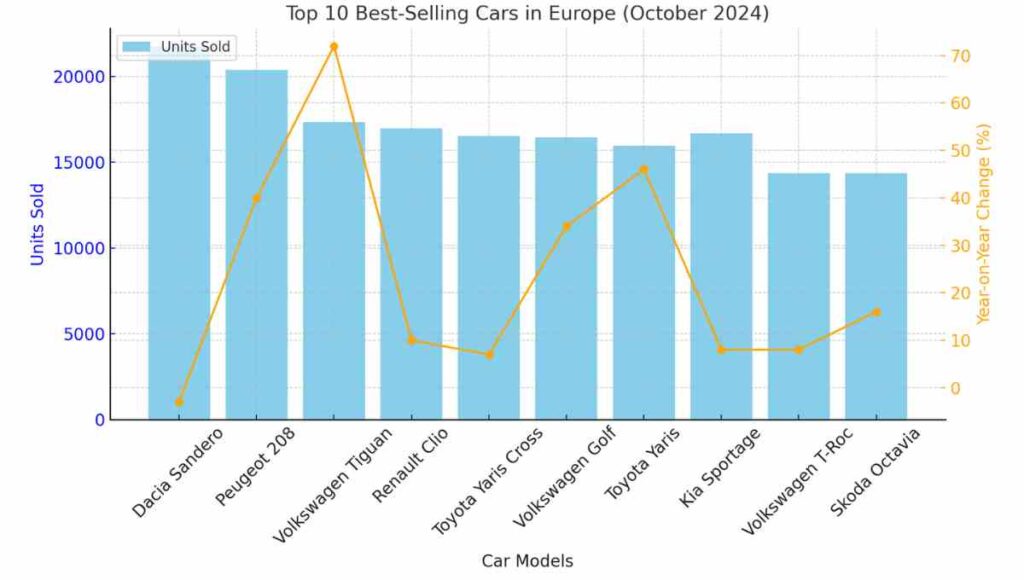

Among the best-sellers, the Dacia Sandero reclaimed its crown as the most popular car in Europe for October 2024. With 21,740 units sold, the Sandero outperformed its competitors despite a slight 3% year-on-year decline.

Its affordability, practical design, and reputation for reliability resonate strongly with European buyers, especially in regions prioritizing budget-friendly options.

The Peugeot 208 secured the second position with a remarkable 40% surge compared to October 2023, totaling 20,389 units sold.

Its sleek design, technological upgrades, and competitive pricing made it a top choice for urban commuters. Meanwhile, the Volkswagen Tiguan capitalized on its recent generational update to claim the third spot. The SUV recorded 17,368 units, a staggering 72% increase year-on-year, underscoring the European appetite for modernized crossovers.

Rounding out the top five were the Renault Clio and Toyota Yaris Cross, which sold 16,987 and 16,542 units, respectively. Both models benefited from steady demand for compact and efficient vehicles, ideal for city driving.

Shifts in the Electric Landscape

While the Tesla Model Y dominated the electric segment earlier in the year, October painted a different picture.

The Skoda Enyaq overtook the Tesla Model Y, claiming the title of the best-selling electric vehicle for the month with 9,977 registrations.

Tesla’s decline was sharp, with Model Y sales dropping 18% to just 8,795 units, pushing it out of the overall top 25 list. This marks a significant shift in consumer preferences, with established European brands like Skoda capitalizing on local manufacturing and tailored offerings to meet regional demands.

Market Dynamics by Brands

Volkswagen remained the leading brand in October 2024, selling 115,027 units—a notable 18% year-on-year increase. Its portfolio, featuring models like the Tiguan and Golf, continued to dominate diverse segments.

Toyota followed with 77,463 sales, bolstered by its hybrid and compact offerings, while Skoda impressed with 70,373 units, marking a 28.2% growth.

On the other hand, Stellantis brands faced challenges. Peugeot and Opel showed moderate performances, but the group’s overall decline was steep, reflecting strategic hurdles.

Luxury brands like BMW and Mercedes sustained their positions in the top five, while Volvo and Cupra recorded double-digit growth, signaling strong demand for premium and performance-oriented vehicles.

Top Models at a Glance

A closer look at sales figures reveals intriguing trends. For instance, the Toyota Yaris, with a 46% growth, secured 15,977 sales, benefiting from its hybrid options.

The Dacia Duster, another budget-friendly SUV, experienced a 44% increase, maintaining its appeal in markets favoring rugged yet affordable vehicles. However, premium electric offerings like the BMW X1 saw a 54% surge, underscoring a growing interest in luxury EVs.

The broader shift toward electrification was apparent in the performance of the Skoda Enyaq and the Tesla Model Y. Despite Tesla’s established presence, it’s clear that European buyers are increasingly gravitating toward homegrown brands that offer tailored solutions for their markets.

Regional Trends in Market Performance

Regionally, the European automobile market showcased mixed fortunes. Spain and Germany recorded growth, with sales increasing by 7.2% and 6%, respectively.

However, other major markets, including Italy, France, and the UK, struggled, registering declines ranging from 6% to 11%.

Smaller markets like Estonia and Lithuania posted impressive growth figures, with Estonia surging by nearly 55%. Conversely, countries like Iceland and Greece saw significant contractions, highlighting uneven recovery patterns across the continent.

Insights from the Sales Data

The data reflects a market undergoing rapid transformation, driven by consumer shifts toward electrification and compact SUVs.

The dominance of the Dacia Sandero and Peugeot 208 underscores the importance of affordability and practicality, while the resurgence of models like the Volkswagen Tiguan signals strong demand for updated technology and design.

October 2024: Top 10 Best-Selling Cars in Europe

| Rank | Model | Units Sold | YoY Change (%) |

| 1 | Dacia Sandero | 21,740 | -3 |

| 2 | Peugeot 208 | 20,389 | +40 |

| 3 | Volkswagen Tiguan | 17,368 | +72 |

| 4 | Renault Clio | 16,987 | +10 |

| 5 | Toyota Yaris Cross | 16,542 | +7 |

| 6 | Volkswagen Golf | 16,455 | +34 |

| 7 | Toyota Yaris | 15,977 | +46 |

| 8 | Kia Sportage | 16,677 | +8 |

| 9 | Volkswagen T-Roc | 14,385 | +8 |

| 10 | Skoda Octavia | 14,372 | +16 |

This table highlights the performance of top models, with many seeing substantial year-on-year growth, driven by strategic updates and evolving consumer preferences.

As the industry navigates these changes, automakers will need to adapt swiftly, focusing on electrification, affordability, and innovation to secure their positions in this dynamic market.